Both debit cards and credit cards offer convenience, security, and global acceptance, but each has its own unique advantages and drawbacks.

By understanding the nuances of these options, you can confidently select the payment methods that best align with your lifestyle, financial goals, and preferences.

What is a debit card?

A debit card is a payment card issued by a financial institution, typically a bank or credit union, that allows cardholders to make purchases and withdraw money from their bank accounts. When using a debit card, the funds are directly and immediately withdrawn from the account linked to the card, essentially acting as an electronic cheque.

Debit cards provide a convenient, cashless payment method, and are widely accepted at merchants worldwide. They often come with a Personal Identification Number (PIN) for added security, especially during ATM transactions or point-of-sale purchases. Debit cards can help cardholders to manage their spending, as transactions are limited to the available balance in the account. Additionally, debit cards generally do not have annual fees.

What is a credit card?

A credit card is a payment card issued by a financial institution, such as a bank or credit card company, that allows cardholders to borrow money up to a predefined credit limit to make purchases or cash advances. Unlike debit cards, which withdraw funds directly from the user's account, credit cards work on the concept of a short-term loan. Cardholders are essentially using the issuer's money with the agreement to repay the borrowed amount, usually with interest if not paid in full by the due date.

Credit cards offer various advantages, such as the ability to earn rewards, benefit from purchase protection, extended warranties, and travel perks. However, they also come with the risk of accruing interest, fees, and potential negative impacts on one's credit score if not managed responsibly. Cardholders receive a monthly statement that details their transactions, and they can choose to pay off the balance in full, make a minimum payment, or pay any amount in between. It's important to note that carrying a balance from month to month incurs interest charges and can contribute to a growing debt.

What is the difference between Credit Card and Debit Card?

While both credit cards and debit cards are widely accepted forms of cashless payment, they differ in several key aspects:

- Source of funds: With a debit card, the money is directly withdrawn from the cardholder's checking or savings account. In contrast, a credit card allows the cardholder to borrow money from the issuing financial institution up to a pre-established credit limit.

- Interest and fees: Credit card users may incur interest charges if they carry a balance from month to month. Additionally, credit cards often have annual fees, late payment fees, and cash advance fees. Debit cards usually do not charge interest or annual fees, although overdraft fees, ATM fees, or insufficient funds fees may apply in certain situations.

- Rewards and benefits: Credit cards typically offer a range of rewards, such as cashback, points, or miles, as well as additional benefits like purchase protection, extended warranties, and travel perks. Debit cards generally offer fewer rewards and perks in comparison.

- Fraud protection: Both credit and debit cards come with security features, but credit cards generally offer stronger fraud protection. Under federal law, credit cardholders have limited liability for unauthorized charges, while debit card users may face higher liability depending on when the fraud is reported.

- Spending control: Debit cards can help users manage their spending, as transactions are limited to the available account balance. Credit cards, on the other hand, may encourage overspending if not used responsibly, as users can spend up to their credit limit, potentially leading to debt.

What's better to use? A credit card or debit card?

The decision of whether to use a credit card or a debit card depends on your financial habits, goals, and individual needs. Both cards offer convenience and are widely accepted, but they have distinct advantages and drawbacks. Here are a few factors to consider when choosing between the two:

- If you have strong financial discipline and are confident in your ability to pay off your credit card balance in full every month, a credit card can offer valuable rewards and benefits. However, if you are prone to overspending or are worried about accruing debt, a debit card may be a safer choice, as it only allows spending within your available account balance.

- If you value rewards and perks such as cashback, points, miles, or travel benefits, a credit card is typically the better choice, as it offers a wider range of incentives compared to debit cards.

- Credit cards generally offer stronger fraud protection than debit cards. If you are concerned about unauthorized charges or identity theft, a credit card may provide better peace of mind.

- If you prefer to avoid annual fees or the possibility of interest charges, a debit card might be the better choice. However, some credit cards offer no annual fees and, if paid in full every month, will not accrue interest.

Ultimately, the choice between a credit card and a debit card depends on your individual financial situation, preferences, and habits. It's important to carefully evaluate your needs and choose the payment method that best aligns with your financial goals and lifestyle. Many people find it useful to have both a credit card and a debit card, using each strategically based on the situation and the benefits they offer.

What are the benefits of a virtual credit card and a virtual wallet?

Virtual wallets and virtual credit cards have gained popularity as they provide convenience, security, and additional benefits to consumers. Here are some of the key advantages of using virtual wallets and virtual credit cards:

- Convenience: Virtual wallets enable users to store multiple credit, debit, and prepaid cards, as well as loyalty cards, and make transactions with just a few taps on their smartphones or other compatible devices. This eliminates the need to carry a physical wallet and simplifies the payment process both in-store and online.

- Security: Virtual wallets and virtual credit cards use tokenization to replace sensitive card information with a unique digital identifier or token. This method ensures that actual card details are not transmitted during transactions, reducing the risk of fraud and identity theft. In addition, most digital wallets require biometric authentication, such as fingerprint or facial recognition, or a PIN for added security.

- Faster checkouts: Using a virtual wallet for contactless payments (like Apple Pay) can significantly speed up the checkout process, as it eliminates the need to swipe, insert, or manually input card information. This is particularly helpful for making quick in-person payments at stores, restaurants, and public transportation systems.

- Real-time tracking: Virtual wallets offer real-time tracking of transactions, enabling users to monitor their spending more effectively. Some virtual wallets also provide notifications for each transaction, making it easier to spot unauthorized charges and report them promptly.

- Rewards and incentives: Many virtual wallet providers partner with merchants and financial institutions to offer exclusive rewards, discounts, or cashback opportunities when using their services. Additionally, virtual credit card users can still enjoy the rewards and benefits associated with their physical cards.

- Budgeting and expense management: Some virtual wallets include built-in budgeting tools, allowing users to set spending limits or categorize expenses to help manage their finances more effectively.

- International compatibility: Virtual wallets can store multiple currencies and be used at contactless payment terminals worldwide, making them a convenient option for travelers who want to avoid carrying multiple physical cards or cash.

- Eco-friendliness: By reducing the need for physical cards and paper receipts, virtual wallets and virtual credit cards contribute to a greener, more sustainable environment.

It's important to consider potential drawbacks to virtual financial products, such as limited acceptance by some merchants, device compatibility, and the reliance on internet access and battery life for transactions. However, as virtual wallet and virtual credit card adoption continues to grow, these issues are likely to become less significant.

Summary

- Choosing between a credit card and a debit card depends on the individual's financial habits, goals, and preferences.

- Debit cards directly withdraw funds from the user's bank account, offering better spending control but fewer rewards and perks.

- Credit cards allow users to borrow money up to a predefined credit limit, and offer rewards and other benefits. However, they come with the risk of interest charges and fees. Credit cards provide other various benefits for both online and in-person transactions, such as fraud protection, purchase protection, extended warranties, rewards, chargeback rights, and interest-free periods.

- Ultimately, selecting the best payment method depends on one's financial situation and personal needs.

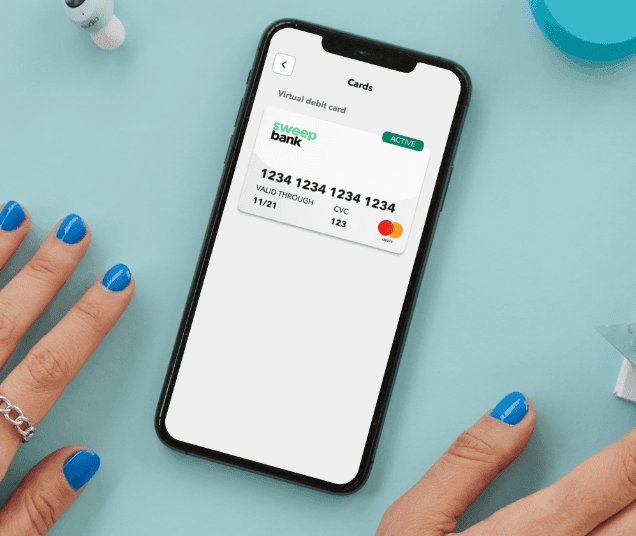

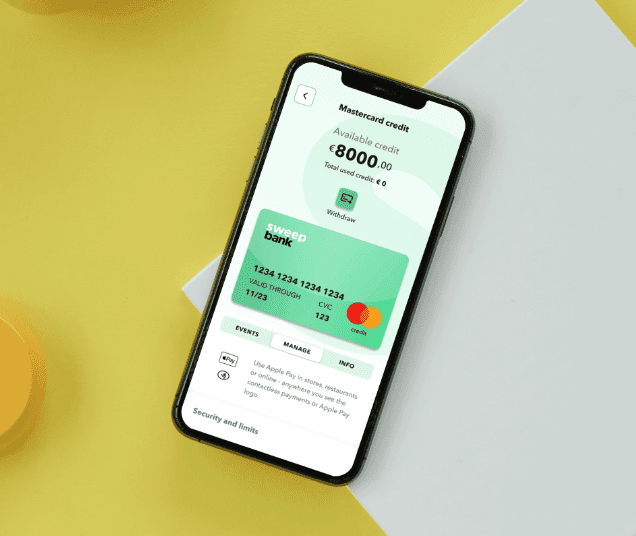

Can’t decide? SweepBank has you covered!

SweepBank offers a fully virtual Mastercard® Credit Card that you can apply for and activate in minutes. SweepBank also offers a free bank account with virtual debit card, powered by Mastercard® – so you will always have the right financial tool when you need it, any time.

Click here to join SweepBank today.